China

Trading Company

![]()

Normally , Setting up a trading company is common option for foreign investment. Trading company can operate wholesale and retail , it could also import and export products . After application of General Tax Payer , the company can issue VAT 17%.

Import Tax : Regarding to import products are needed to pay import tax , some products are also needed to pay extra consumption tax.

Export Tax & Duty Free : The majority of export products are no need to pay export tax.

VAT&Consumption Tax : Except for certain forbidden products and techniques , most export products are duty free, which means no need to pay VAT and Consumption tax.

Related Links:

1. Business Ranges

Apart from some special business ranges ,such as food/medical/chemical etc, are needed to apply for Special Permit, trading company allows operating likes wholesale /trading /import & export /agency / consulting and other relevant businesses.

2. Import & Export Management

Foreign owned trading companies are allow to apply for Import & Export rights for operating general transactions. General Trading which means the company is doing singly import businesses or singly export business. Chinese custom will offer loan allowance accordingly, includes import-processing materials, domestic processing and export , self-purchasing and export , import foods, domestic-made fuel/ materials/components for foreign vessel and airplane,etc.

3. Foreign Exchange Management

China has a specific system for foreign exchange,includes settlement,currency selling and import&export payment verification. Generally, company’s foreign currency income shall be sold by certain bank, and outcome shall be purchased in the certain bank. Wholly Foreign owned company can open a foreign account and save a certain amount as normal income.

Since August 2007, Chinese Government cancelled settlement systems mandatorily. State Foreign Exchange Bureau amends “ Foreign Exchange Management Ordinances”,in relation to cancel all oversea’s income have to be transferred to domestic, and suggest domestic organisation and individual can leave in overseas or transfer back to domestic. Regarding to the specific saving conditions and terms depends on the stipulation of Foreign Exchange Management.

December 31th 2010, State Foreign Exchange Bureau issued “ Regarding to storage of Import&Export “ . New ordinance has been operated since January 1st ,2011. Generally , Company imports and exports goods can pay to the certain bank by virtue of Agreement. Company exports goods also needed to comply with settlement verification.

Remarks:Since July1st 2004, all capable international manufacturers have right to refund or free tax; regarding to trading companies whom export goods also have right to refund or free tax; regarding to Small Scale Tax Payer’s trading companies whom export goods are duty free.

4. Main Taxes for WOFE or Foreigner

✦Company Income Tax:

Chinese Company’s income tax is 25%

✦Value Added Tax (VAT) :

Chinese VAT is 17% in relation to manufacturing, circulation of various aspects of the new value, or value-added goods. Where in China engaged in selling or importing,processing,repairing,and replacement serving are required to pay VAT. Chinese tax bureau subject to the companies’ accounting systems to recognise whether they are General Tax Payer or Small Scale Tax Payer. Small Scale Tax refers annual turnover lower than standard with unwell accounting system. The standard is engaging to manufacturing , providing tax payable services , retails and wholesales whom annual VAT tax fee lower than RMB50million or other annual tax fee lower than RMB80million. General taxpayer refers annual taxable sales higher than Small Scale Tax payer with standard accounting system. However, regarding to those individual,non-entity organisation those whom annual taxable amount higher than small scale tax standard are recognising to Small Scale Tax payer.

✦Tariffs:

Import tariffs have ordinary and favourable, no favourable tax agreement with China are required to pay ordinary tariff;with favourable tax agreement with China are required to pay favourable tax.

✦Business Tax:

It depends on each industries and difference business. Normally there 4 types of it,includes (1) transportation, construction, telecommunications, culture and sports tariff rate of 3%; (2) finance and insurance 5% (adjusted to 8% in 1997, 2001 was reduced to 7 %, reduced to 6% in 2002, 2003 and later reduced to 5%)(3) services, transfer of intangible assets, real estate sales three tariff rate of 5%; (4) tariff rate for the entertainment industry 5-20%, the specific applicable tax rate is determined by the provincial government.

✦Land Tax:

Land Taxi in relation to transfer of land (fixed) rights whom gain the profits .

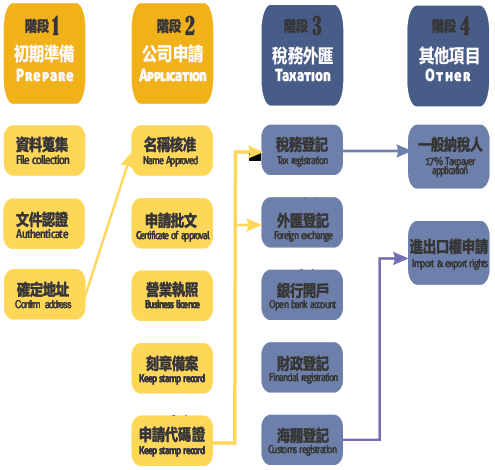

5. Company Registration Process

Q & A of Setting Up Chinese Trading Company

Q : How Taiwan investment incorporates in China?

A : Normally, Taiwan individual or entity invest in China directly, however, entity has to provide Business License or individual has to provide Identity Certification. All files are needed to notarise by Straits Exchange Foundation / Association for Relations Across the Taiwan Straits , afterwards, get permits from Chinese government. Nowadays, more and more investors will set up a company via Offshore company, the good sides are simplified legislation and flexible.

Q : How Foreign Investment incorporates in China ?

A : Minimum registered capital is RMB500,000. There is at least 1 director and a supervisor , the registered address has to located in office building. Leasing Agreement is required . If the company needs to apply for VAT, the office size is one of applying condition. It is necessary to apply extra Import&Export rights if the company wants to import and export goods.

Q : Does the registered capital is needed to full paid ?

A : So far, 20% of registered capital is needed to pay at the first place , the balance has to be paid within 2 years. However, it has changed , some cities are accepted pay accordingly.

Q : How long to set up a WOFE (trading company) well ?

A : Normally it takes approximately 1month. However, if client wants to apply for issuing VAT and IMP&EXP rights, it might take approximately 3 months, it depends on the real status.

Q : Any favorable tax for trading company?

A : Along with many foreign investment in China, the government has changed and amended tax rates, especially for certain import and export products. Besides, China builded up Shanghai Free Trade Zone, which means international trading is getting easier to run in China.